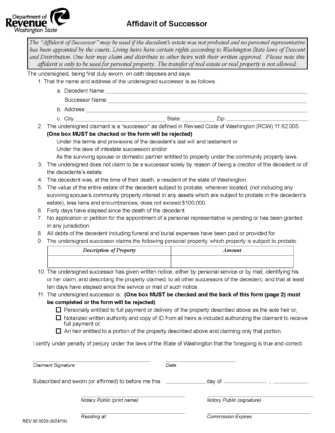

A Washington small estate affidavit allows a recently deceased individual’s estate to be distributed to their beneficiaries without court involvement. Referred to as an “Affidavit of Successor,” this form may be used by any “successor” as defined in RCW 11.62.005(2)(a) to avoid formal probate, as long as the estate is valued at less than $100,000 and does not include real estate. This affidavit may be used to collect personal property such as vehicles, jewelry, furniture, and bank accounts. Any property automatically passing to an individual should not be included (i.e., a life insurance policy or living trust).

Any successor (excluding creditors) may file the Affidavit of Successor. A successor is anyone entitled to claim the decedent’s property; this may include the State itself if the decedent had no heirs. Before the affidavit may be filed, the following requirements must be met:

As soon as the requirements in the first step have been met, the filing successor may complete the Affidavit of Successor. The successor must provide a description of the property and its value, and they must describe their claim to said property by stating that one of the following is true:

Once complete, a notarized copy of the affidavit, the decedent’s will (if any), and the decedent’s social security number must be sent via certified mail to:

Department of Social and Health Services

Office of Financial Recovery

Box 9501

Olympia, WA 98507-9501

The successor may provide a copy of the affidavit and the decedent’s death certificate to any transfer agent to retrieve the decedent’s property. The assets will then be distributed as detailed in the will. If there is no will, the property will be allocated based on Washington intestacy laws as stated in RCW 11.04.015.